Specifically for individual taxpayers gross income does not include 50 of any gain from the sale or exchange of qualified small business stock held for more than 5 years. Click on the product number in each row to viewdownload.

Irs Fixes Error In Schedule D Worksheet Taxing Subjects

If the sum of short-term capital gains or losses plus long-term capital gains or losses is a gain the 28 Rate Gain Worksheet will be produced if either of the following is true.

28 rate gain worksheet 2018. A 28 rate gain is reported on line 4 of the 28 Rate Gain Worksheet - Line 18 in the Schedule D Form 1040 instructions. 28 Rate Gain Worksheet. If there is an amount in box 2d include that amount on line 4 of the 28 Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D.

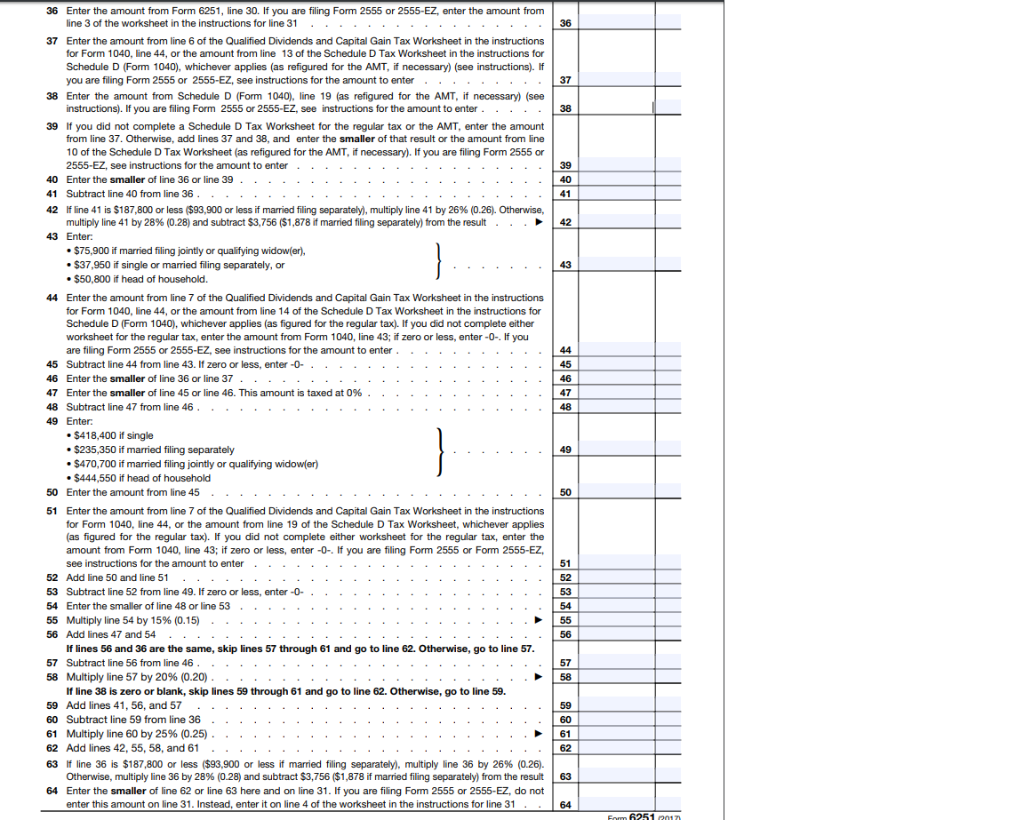

You can also learn how to set up an autoresponder how to write articles how to build a website how to market and even how to promote your business. 2018 Itemized Deduction Worksheet Excel loss carryover worksheet carla s worksheet x child tax credit worksheet itemized deductions worksheet macrs worksheet mip deduction worksheet paulette s worksheet i paulette s worksheet ii personal allowances worksheet qualified dividends and capital gain tax worksheet Otodom Szeregowe Domy Katowice 1000 Ideas About Black Wedding Hairstyles On. The IRS explained that the tax calculation did not reflect the new regular tax rates and brackets for certain Schedule D filers who had 28 rate gain which is taxed at a maximum rate of 28 reported on line.

There are so many ways that this guide will help you succeed. During the 5-year period ending. Form 8949 Part II includes a section 1202 exclusion from the eligible gain on QSB stock or.

Click on column heading to sort the list. Form 8949 Part II includes a section 1202 exclusion from the eligible gain on QSB stock or. Select a category column heading in the drop down.

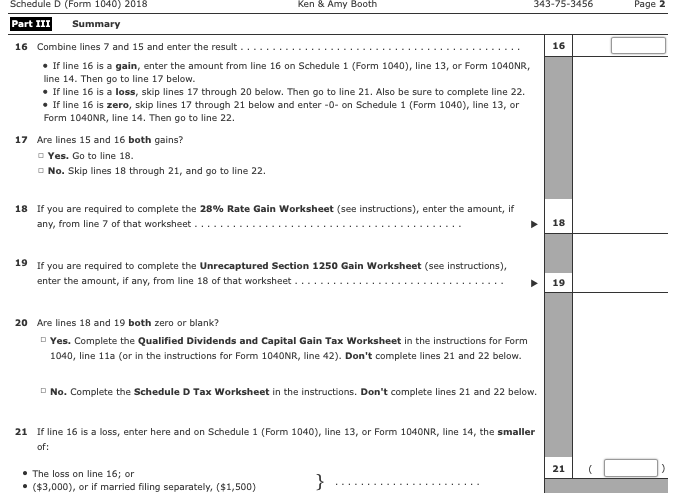

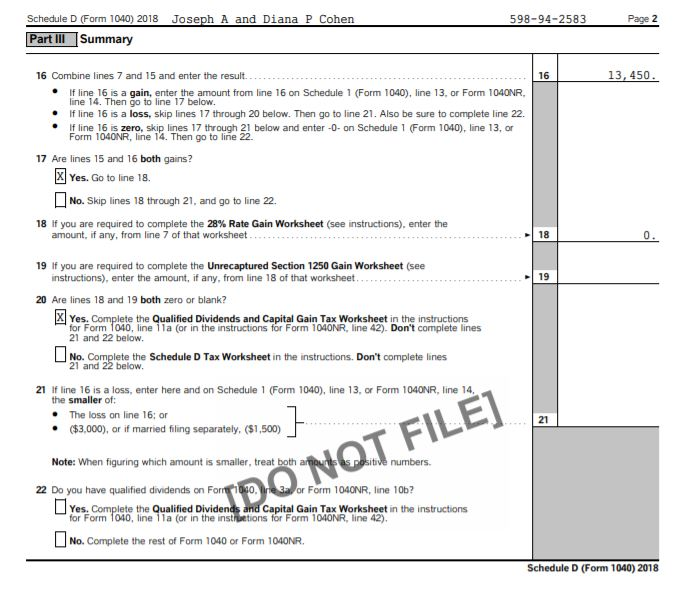

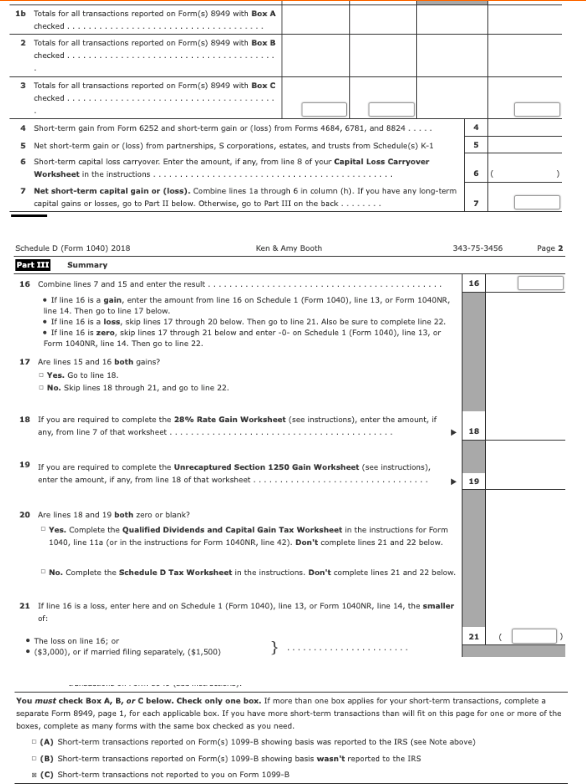

If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain Worksheet of Schedule D according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. If you received capital gain distributions as a nominee that is they were paid to you but actually belong to someone else report on Schedule D line 13 only the amount that belongs to you. The remaining 50 is taxed up to 28.

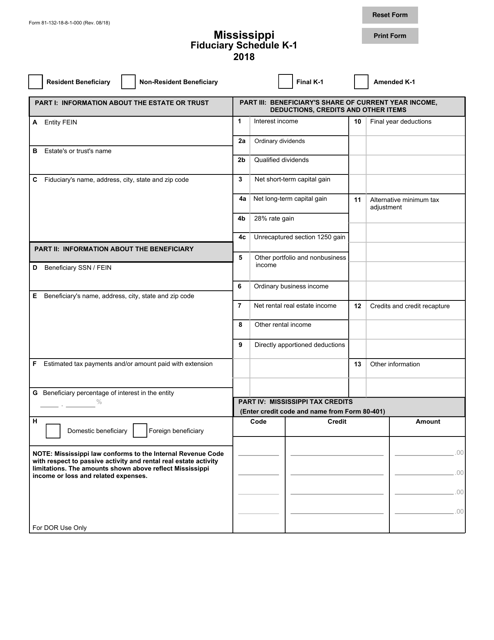

Of the gain 3 of any section 1202 exclusion you reported in column g of Form 8949 Part II with code Q in column f that is 60 of the gain and 3 of. If this is the final return of the estate or trust and there are excess deductions on termination you may deduct the reporting information. To view the tax calculation on the Schedule D Tax Worksheet.

It is a simple tool to use but it does so much more than that as well. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 19 of Schedule D. To figure your tax on collectibles gain you have to use the worksheet on page 8 of Form 1040 Schedule D instructions.

On May 15 the IRS notified tax software companies that it had discovered an error in the instructions for the Tax Worksheet for the 2018 Schedule D Capital Gains and Losses. Get thousands of teacher-crafted activities that sync up with the school year. Get thousands of teacher-crafted activities that sync up with the school year.

If the sum of short-term capital gains or losses plus long-term capital gains or losses is a gain the 28 Rate Gain Worksheet will be produced if either of the following is true. View andor save documents. To ask a question on Tax.

March 14 2019 by Leo Garcia. The summarized reporting information reflects references to forms in use for. Line 18 If you checked Yes on line 17 complete the 28 Rate Gain Worksheet in these instructions page 10 if either of the following apply for 20xx.

When the long-term capital loss carryover is forced on Screen BD in the Income Folder the 28 Rate Capital Gain line 5 and Unrecaptured Section 1250 line 16 Worksheets do not report the forced amount. You may be able to enter information on forms before saving or printing. The maximum tax rate on collectibles gain is 28 percent.

Worksheet November 26 2018 0029. 28 Rate Gain Worksheet. 28 Rate Gain Worksheet.

Override on the forms. If both you and your spouse meet these tests and you file a joint return you can exclude up to 500000 of gain but only one spouse needs to meet the ownership requirement in Test 1. Attachment sequence order shown.

It was originally a product developed in Mexico. Generally if you meet the following two tests you can exclude up to 250000 of gain. The 28-rate gain worksheet was put together by Sean at his site.

Ad The most comprehensive library of free printable worksheets digital games for kids. The IRS noted the impacted returns as follows. State Electronic Filing Guide.

The 28 Rate Gain Worksheet is definitely a product that we have not seen before. Per the instructions the 28 rate will generate if an amount is present on Schedule D lines 18 andor 19. Any gain you cant exclude is taxable.

The taxable part of a gain from selling Internal Revenue Code Section 1202 qualified small business stock is taxed at a maximum 28 rate. Ad The most comprehensive library of free printable worksheets digital games for kids.

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Nidecmege

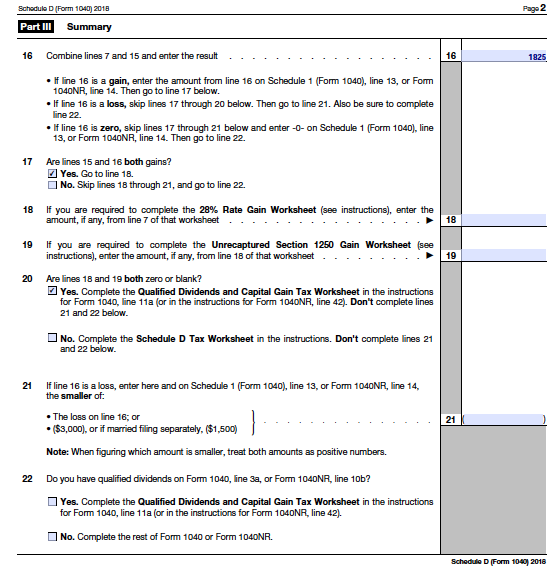

Ken Birthdate July 1 1987 And Amy Birthdate July Chegg Com

Https Www Gillibrand Senate Gov Download 2018 Taxes

Https Www Irs Gov Pub Irs Prior I1041sd 2018 Pdf

Form 81 132 Download Fillable Pdf Or Fill Online Resident Non Resident Beneficiary 2018 Mississippi Templateroller

The Images Attached Are What I Need To Put These Chegg Com

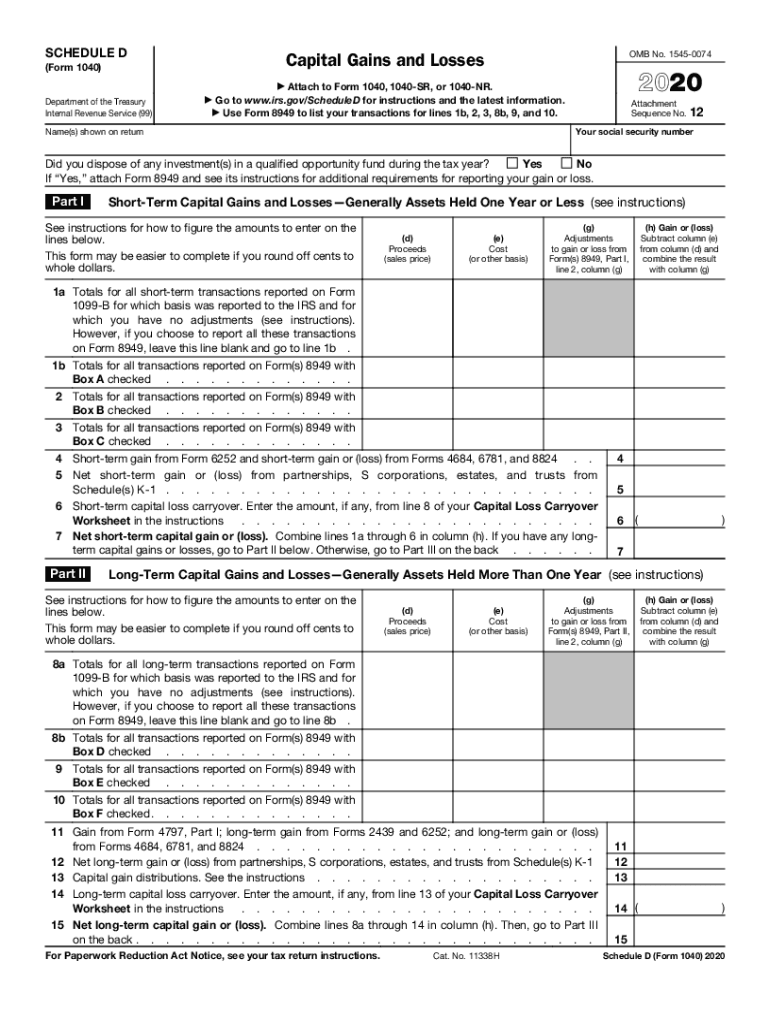

Irs 1040 Schedule D 2020 2021 Fill Out Tax Template Online Us Legal Forms

28 Rate Gain Worksheet Fill Online Printable Fillable Blank Pdffiller

Capital Gain Worksheet 2015 Promotiontablecovers

How To Report These On Schedule D Tax Return James Chegg Com

How To Report These On Schedule D Tax Return James Chegg Com

Irs 1040 Schedule D Instructions 2020 2021 Fill Out Tax Template Online Us Legal Forms

Ken Birthdate July 1 1987 And Amy Birthdate July Chegg Com

Publication 17 Your Federal Income Tax Chapter 17 Reporting Gains And Losses Comprehensive Example

Https Www Gillibrand Senate Gov Download 2018 Taxes

Amt Qualified Dividends And Capital Gains Worksheet Promotiontablecovers

Amt Qualified Dividends And Capital Gains Worksheet Promotiontablecovers

No comments:

Post a Comment